The most important thing in brief

- Active Funds: Fund managers aim to outperform the market,

which leads to higher costs. These funds are traded through banks or fund

management companies.

- Passive ETFs: These passively replicate the performance of

an index and do not use active fund management—resulting in lower costs.

ETFs are traded directly on the stock exchange.

- Main Difference: Both hold bundles of stocks, but active

funds aim to outperform through strategic selection, while ETFs simply

mirror the index's performance.

Explanations: Funds vs. ETFs – A Quick Overview

To clearly distinguish between ETFs and traditional funds, it's essential to understand that

both are types of investment funds that allow investors to participate in the capital

markets.

Passive ETFs

ETF stands for Exchange Traded Fund. These are investment funds traded on the stock exchange.

Investors can buy ETF shares directly via the stock market or through their bank. Passive

ETFs are designed to track an index—like the DAX or MSCI World—and mirror its performance.

When the index rises or falls, the ETF reflects that movement, as it contains the same

securities, such as stocks or real assets like real estate. Unlike active strategies, ETFs

passively follow market performance.

Actively Managed Funds

Actively managed funds are overseen by a fund manager who selects securities or assets based

on a specific investment strategy. These can include equity funds, bond funds, real estate

funds, commodity funds, or mixed funds. The goal is to outperform the market through

strategic asset selection, seeking to generate excess returns (alpha) over time.

Are There Passive Funds and Active ETFs?

In everyday language, "ETF" usually refers to passive ETFs that track an index. However,

there are also actively managed ETFs—managed by a fund team without following a specific

index. These are typically labeled explicitly as "active ETFs" to differentiate them.

Likewise, when people mention "funds," they usually mean actively managed funds. Passive

funds do exist too and are usually called "index funds" or labeled as such to indicate their

passive management style.

Comparison: What is the Difference Between Funds and ETFs?

Funds and ETFs both belong to the broader category of investment funds. However, there are

key differences—such as in objectives and risk levels. Additional distinctions include fund

management and associated costs. Comparisons between funds and ETFs often refer to the

common understanding that contrasts actively managed funds with passively managed ETFs.

The differences between funds and ETFs at a glance

|

Funds |

ETFs |

| Management |

Actively managed funds are composed and managed by a fund management team.

|

Passive ETFs replicate the performance of a specific index. |

| Trading |

Fund shares can be bought and sold through a fund company, appropriate

providers, or a bank. |

ETF shares are traded on the stock exchange. Investors can invest directly

via an exchange or through intermediaries. |

| Performance |

The fund management team of an active fund attempts to outperform the market

and generate higher returns. |

ETFs reflect the performance of the underlying index. |

| Costs |

Active funds have higher costs due to management fees, success bonuses, and

front-end loads. |

Passive ETFs are typically much cheaper than active funds. |

| Transparency |

Since active funds are managed by a fund manager, investors often have

limited insight into current holdings. |

Passive ETFs mirror the index directly, providing full transparency into the

holdings. |

| Risk |

Funds are subject to general market risk and tend to respond slower to

market changes, which may affect short-term performance. |

ETFs also carry market risk. Because they follow an index, market movements

are reflected quickly. |

Management and Trading: Actively Managed Funds vs. Passive ETFs

Unlike ETFs, traditional funds are issued by an investment company—ETFs, on the other hand,

are traded on the stock exchange. Investors can only sell fund shares back to the fund

company or bank, or trade them over-the-counter. This slows down the trading process. When

an investor decides to buy or sell, the transaction is executed at the earliest the next

day. The fund company also sets a daily price for shares, which applies until the next

valuation. ETFs allow real-time trading during exchange hours at current market prices.

Returns and Costs: ETFs vs. Funds

While passive ETFs offer solid return opportunities, they come with significantly lower total

costs compared to actively managed funds. ETF providers do pay license fees to replicate an

index. However, active funds incur much higher costs due to fund management alone. These

include management fees, custody fees, and potentially a performance fee when a certain

return is reached by the manager.

Additionally, active funds usually charge an entry fee (front-end load) of about 5% of the

investment amount. Transaction costs from buying and selling securities within the fund also

raise the overall cost. ETFs are far more cost-efficient, as there are typically no entry

fees, no active management, and lower transaction costs.

On average, active funds incur ongoing costs of around 1.5–2.5% per year, and sometimes more.

The average fund cost is 2.26%. ETFs and index funds range between 0.05–1.0%. WeltSparen’s

digital wealth management charges between 0.36% and 0.61% annually.

These cost differences directly affect the net return. Suppose both a fund and an ETF deliver

a 5% gross return. After costs, the fund may yield only 2.5–3.5%, whereas the ETF could

achieve 4–5%. To highlight this impact, a scenario with a €250 monthly investment over 24

years is calculated.

Return comparison between funds and ETFs

| Time Period |

Fund with avg. costs of 2.26% p.a. |

ETF with avg. costs of 0.59% p.a. |

| 1 Year |

€3,011.61 |

€3,063.07 |

| 6 Years |

€19,298.80 |

€20,512.57 |

| 12 Years |

€41,846.40 |

€47,042.52 |

| 18 Years |

€68,189.69 |

€81,355.04 |

| 24 Years |

€98,967.64 |

€125,733.16 |

| Total Invested |

€72,000 |

€72,000 |

| Total Return |

€29,967.64 |

€53,733.16 |

For both funds and ETFs, it's assumed that the annual return averages around 5%. Due to the

difference in ongoing costs alone, a higher return of €23,765.52 before taxes is generated

over a 24-year investment period. The more money investors contribute monthly, the greater

the difference in actual profits between funds and ETFs can become.

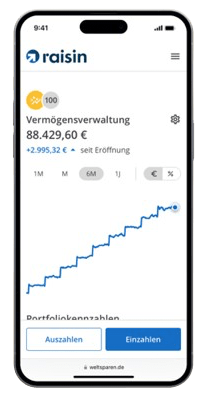

For those looking to invest in cost-efficient ETFs and index funds, digital wealth management

with various risk profiles is a compelling option. Based on the investor's information, a

recommended investment strategy is provided. The pre-configured portfolios differ in their

allocation of equities and bonds, which defines the risk level. A portfolio with a higher

proportion of bonds is considered less risky, while more equities increase potential

returns.

Global and Diversified Portfolios

The portfolios in our digital wealth management platform invest your capital in a

broadly diversified way. This means you benefit from global equity and bond markets

through a single portfolio.

Our investment team follows a strategy based on insights from 50 years of leading

financial research.

Learn more about the investment strategy >

Transparency: Differences Between Funds and ETFs

Whether investors choose active funds or passive ETFs often depends on how much control they

want to retain. With ETFs, index replication ensures clarity on which assets are included.

Most ETFs closely follow their benchmark index. Any deviation is called the tracking

error—higher tracking error means greater deviation from the underlying index.

This makes passive ETFs highly transparent, giving investors full visibility into what they

own. For example, if they want to exclude a specific company’s stock, they can sell their

ETF shares on the exchange quickly and easily.

Active funds, however, are less transparent. Although fund reports are sent out periodically,

key portfolio changes can occur between reports. Investors hand over partial control to the

fund managers.

Only when the next report is published can investors verify whether the investments still

align with their values. A fund manager might add a company’s stock right after a report is

issued, and investors may not be aware until the next disclosure—potentially discovering

their money supports a company they do not wish to back.

Risk: Funds vs. ETFs

In general, both ETFs and mutual funds are subject to the same capital market risks, as their

performance cannot be predicted with certainty. Prices fluctuate, and both investments are

exposed to inflation risk, liquidity risk, tax-related risks, and other common investment

risks. However, due to structural differences, each type carries specific risks.

Specific Risks of Traditional Investment Funds:

- High or fluctuating entry fees

- Price risks due to market volatility

- Concentration in a specific region, industry, or currency increases risk

- Performance statistics in reports may be misleading and require interpretation, as they

might capture volatile timeframes

- It's important to consider the benchmark used to assess performance and align investment

strategy accordingly

- The fund company may cancel management and transfer assets to another provider, possibly

under unfavorable conditions

Specific Risks of ETFs:

- Price risk due to fluctuations in the tracked index

- Currency fluctuations can affect value if the ETF and the index use different currencies

- Price discrepancies may occur if ETFs are traded outside the index's market hours

- Immediate response to market shifts may lead to short-term losses

What Are the Advantages and Disadvantages of Funds and ETFs?

Both mutual funds and ETFs offer distinct benefits and challenges for investors. The

following section summarizes the key pros and cons of each investment type.

Advantages and Disadvantages of Mutual Funds

Advantages:

- Risk management is possible through active fund management

- Investors benefit from the expertise of fund managers

- Low time commitment for investors

- Investments are classified as segregated assets

- Savings plans are available

Disadvantages:

- Market fluctuations can occur at any time

- Higher costs due to management and transaction fees

- Investors rely on the decisions of fund managers

- Fund shares usually can only be sold back to the fund provider or bank

- Lower transparency compared to ETFs

- Studies show that funds rarely outperform the market

Advantages and Disadvantages of ETFs

Advantages:

- Lower costs than actively managed funds

- Tradable on the stock exchange

- Broad diversification of risk

- Quick response to market events possible

- Investments are classified as segregated assets

- High level of transparency

- Savings plans are available

Disadvantages:

- Market fluctuations can occur at any time

- Over-diversification may dilute gains from high-performing assets

- No active risk management from fund managers

- ETFs tracking speculative assets (e.g., cryptocurrency) carry high risk

- Frequent trading can increase costs and reduce returns

Studies: Do ETFs or Mutual Funds Perform Better?

A 2013 study by financial analysts Rick Ferri and Alex Benke titled “A Case for Index Fund

Portfolios” first demonstrated the advantage of passive investment portfolios over actively

managed fund portfolios.

“Index funds are more likely to outperform actively managed funds when combined into a

portfolio.” (A Case for Index Fund Portfolios, 2013, PDF/English)

Recent studies confirm these findings. A large-scale study by Standard & Poor’s in 2021 found

that over 90% of active funds failed to outperform the market over a typical 20-year

investment period. A one-year analysis conducted by the rating agency Scope at the beginning

of 2022 showed that only around 29% of the funds examined managed to generate excess

returns.

A frequently cited argument for actively managed investment funds is their ability to manage

risk. Active fund managers can reduce losses in declining markets, whereas ETF and index

fund strategies reflect market downturns proportionally. Although this is theoretically

sound, actual performance may differ in practice.

It is important to highlight that ETF and index fund portfolios consistently outperformed

across all time periods. The outperformance increases as the investment period lengthens.

The analysis included the two major financial market crises in 2000 and 2008.

“The likelihood of outperformance by index fund portfolios increases when the analysis period

is extended from 5 to 15 years.” (A Case for Index Fund Portfolios, 2013)

Source: Ferri / Benke (2013): “A Case for Index Fund Portfolios – Investors holding only

index funds have a better chance for success” (Whitepaper, PDF,

English).

Risk Warning: Every investment in the capital market

involves both opportunities and risks. The value of investments may rise or fall. In the

worst-case scenario, there may be a total loss of the invested amount. You can find all

detailed information under Risk Information.